COVID-19 Tenant Relief Act (CTRA)

The application process for the State’s rental assistance program is now open. Some local governments have also opened their application process for rental assistance. Visit CAA’s Rental Assistance Payment Program Page at caanet.org/rapp/ for more information.

On January 29, 2021, Governor Gavin Newsom signed into law SB 91. It took effect immediately.

CAA’s Industry Insight – Frequently Asked Questions: SB 91 – Extension of COVID-19 Tenant Relief Act explains how SB 91 changes the previously existing eviction moratorium law.

This Industry Insight is available free of charge.

YouTube Video – Summary of SB 91

CAA WEBINAR – SB 91: New State Rental Assistance Program and Extension of Statewide Eviction Moratorium

This webinar, originally broadcast on Friday, February 5, 2021, is now available on-demand. Click the button below to purchase the course.

Senate Bill 91 Highlights- COVID-19 Relief: Tenancy: Federal Rental Assistance

SB 91 extends the COVID-19 Tenant Relief Act (AB 3088, 2020) for another five months until June 30, 2021, and creates a state government structure to pay up to 80 percent of past due rent to landlords.

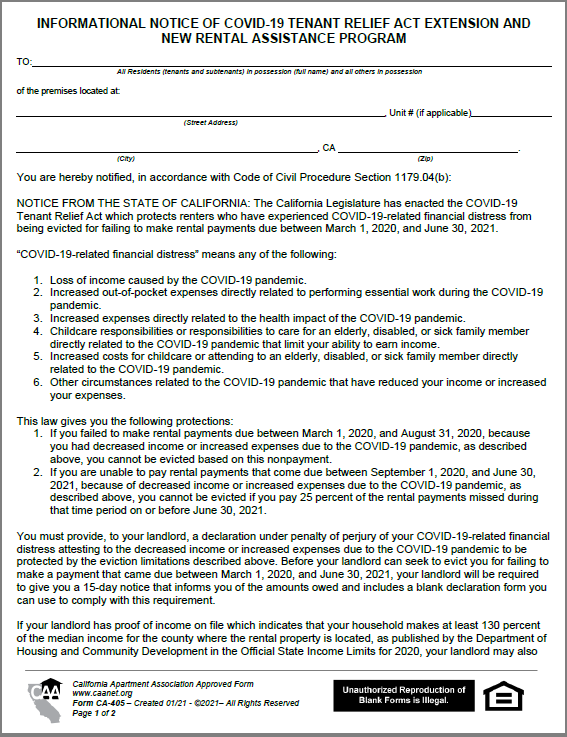

CA-405 – Informational Notice of COVID-19 Tenant Relief Act Extension and New Rental Assistance Program – MUST BE PROVIDED BY FEB. 28

SB 91 requires landlords to send this informational notice to their residents about this new law by no later than February 28, 2021. Failure to do so may affect your ability to evict a resident who fails to comply with CTRA.

This form is available free of charge.

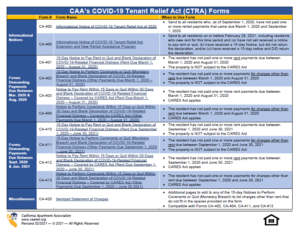

Compliance Materials

CAA has published new and updated forms for complying with CTRA.

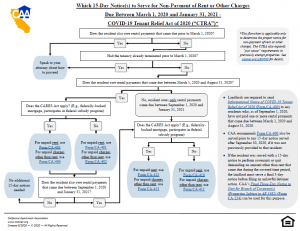

Are you unsure of which form to use?

To help you determine which form should be served,

click on the CAA COVID-19 Forms Flowchart.

Translation requirement for the declaration of COVID-19 related financial distress

If the landlord negotiated the rental/lease agreement in Spanish, Chinese, Tagalog, Vietnamese, or Korean and, as a result, was required by state law to provide a copy of the rental/lease agreement in one of those languages, the landlord is also required to provide the unsigned copy of a declaration of COVID-19-related financial distress to the resident in that language. As required by CTRA, the Department of Real Estate has official translations of the text of the declaration on their website, which can be found here.

For more information about foreign language translation requirements, see CAA’s Industry Insight – Foreign Language Rental Agreements and Leases.

Related Industry Insights

| Industry Insight – AB 3088 – The COVID-19 Tenant Relief Act of 2020 |

Frequently Asked Questions: The COVID-19 Tenant Relief Act of 2020 (AB 3088) |

| Industry Insight – CARES Act Federal Eviction Moratorium |

Industry Insight – CDC Eviction Moratorium |

Interaction Between CTRA and Local Eviction Moratoria

CTRA vs the City of San Jose

CTRA vs the City of Sacramento

CTRA vs the County of Los Angeles

CTRA vs the City of Los Angeles

Local COVID-19 Tenant Protections

CAA has created summaries of the moratoria in the most populous areas.

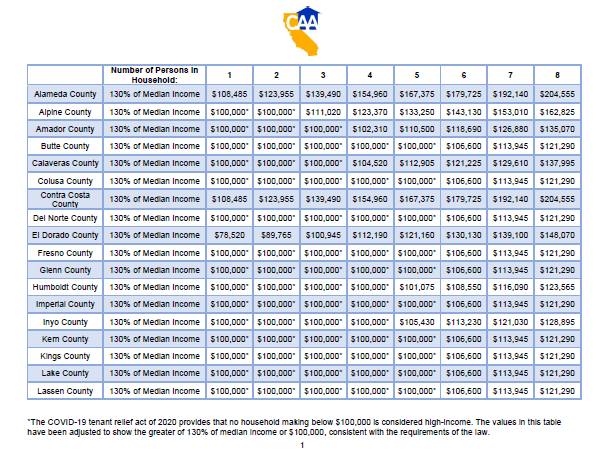

What is 130% of Median Income for your county?

The values in this table have been adjusted to show the greater of 130% of median income or $100,000, consistent with the requirements of the law.